What Is Shopping Addiction?

Shopping addiction, also known as compulsive buying disorder (CBD), is a behavioral addiction marked by an uncontrollable urge to shop and spend, often in ways that lead to financial, emotional, and relational consequences.

Although not formally classified as a separate disorder in the DSM-5-TR (2022), compulsive shopping is recognized by many mental health professionals as a form of impulse control disorder and is closely related to process addictions, such as gambling.

Compulsive buyers may shop to:

- Relieve stress or anxiety

- Improve mood

- Feel a sense of control or identity

- Escape from boredom or depression

Shopping addiction can affect any gender or age group, but studies suggest it is more common among women and often begins in late adolescence or early adulthood.

Signs and Symptoms of Shopping Addiction

Shopping addiction goes beyond just liking to shop. Common signs include:

- Frequent, unnecessary purchases of things you don’t need

- Spending beyond your means, leading to debt or financial problems

- Emotional highs during shopping, followed by guilt or regret

- Hiding purchases or receipts from family or partners

- Using shopping as a way to cope with emotions

- Inability to stop or control shopping despite consequences

- Neglecting responsibilities due to time spent shopping

For many, the addiction is not about the items themselves, but the emotional relief or excitement gained from the act of buying.

Common Triggers and Underlying Causes

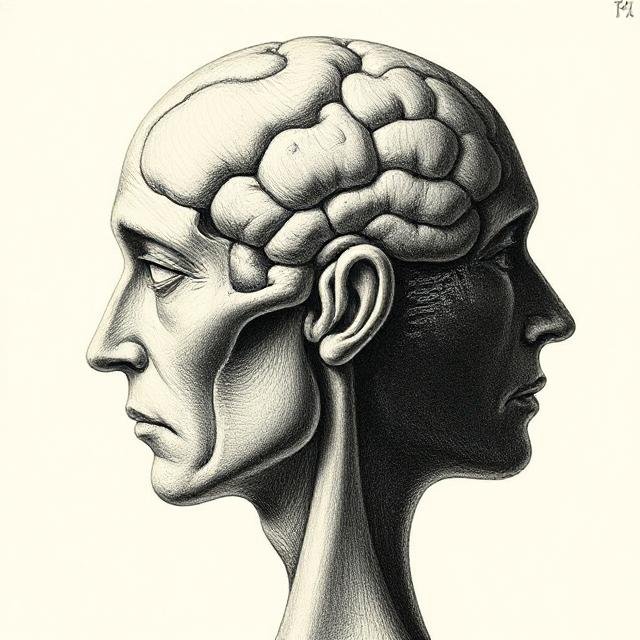

Shopping addiction often develops from a combination of psychological, social, and neurobiological factors.

Emotional Triggers

- Depression

- Anxiety

- Loneliness

- Low self-esteem

- Stress or trauma

External Triggers

- Sales, advertisements, or online deals

- Peer pressure or social media influence

- Boredom or unstructured time

Psychological Causes

- Impulse control issues

- Addictive personality traits

- Past trauma or emotional neglect

- Co-occurring disorders like bipolar disorder, OCD, or borderline personality disorder

Shopping Addiction vs. Normal Shopping Behavior

It’s normal to occasionally indulge in retail therapy or enjoy spending money. Shopping becomes problematic when it is:

| Normal Shopping | Compulsive Shopping |

|---|---|

| Done for practical needs | Driven by urge or emotion |

| Planned and budgeted | Impulsive, unplanned purchases |

| Feels satisfying | Feels out of control or regretful |

| Doesn’t interfere with life | Causes financial or social harm |

Consequences of Compulsive Shopping

Unchecked shopping addiction can lead to serious personal and financial issues, including:

- Debt and bankruptcy

- Strained relationships or divorce

- Emotional distress (guilt, shame, anxiety)

- Job or academic problems

- Hoarding or clutter-related stress

- Isolation or avoidance behavior

The cycle of urge–purchase–relief–guilt reinforces the addiction over time.

Diagnosis and Classification

Although not a distinct diagnosis in the DSM-5-TR, compulsive buying behavior may fall under:

- Other Specified Impulse-Control Disorders

- Behavioral Addictions (under ongoing research for future classification)

Mental health professionals use clinical interviews, behavioral assessments, and tools such as:

- Compulsive Buying Scale (CBS)

- Yale-Brown Obsessive Compulsive Scale (Y-BOCS) adapted for shopping

Diagnosis often involves ruling out bipolar disorder, in which excessive spending can occur during manic episodes.

Treatment Options for Shopping Addiction

Effective treatment involves a multi-dimensional approach, combining therapy, support, and financial education.

Psychotherapy

- Cognitive Behavioral Therapy (CBT): Helps identify triggers and replace harmful thoughts with healthy coping strategies

- Dialectical Behavior Therapy (DBT): Useful when emotional regulation is a core issue

- Motivational Interviewing: Builds internal motivation to change

Medication

- SSRIs (Selective Serotonin Reuptake Inhibitors) may be prescribed to manage co-occurring depression or OCD-like symptoms.

- Mood stabilizers in cases of underlying bipolar disorder

Financial Counseling

- Helps individuals understand debt, budgeting, and savings

- Provides tools to avoid relapse, like account monitoring and spending limits

Support Groups

- Debtors Anonymous

- Online or in-person compulsive shopping support groups

Community support reduces shame and increases accountability.